Download #

- The latest release of our PDF Invoices & Packing Slips for WooCommerce – XRechnung is publicly hosted on Github.

- This extension adds EN16931 XRechnung (UBL Invoice) support to our main, free PDF Invoices & Packing Slips for WooCommerce plugin.

Activation #

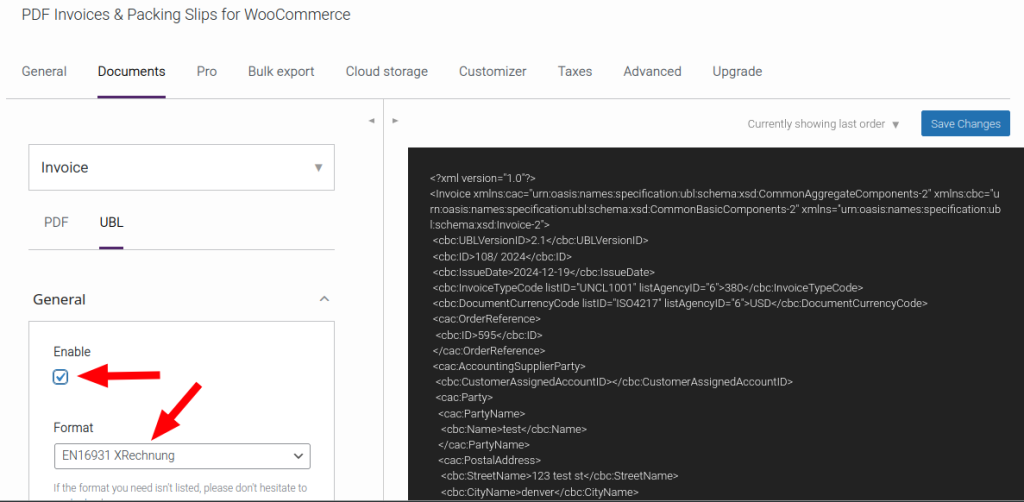

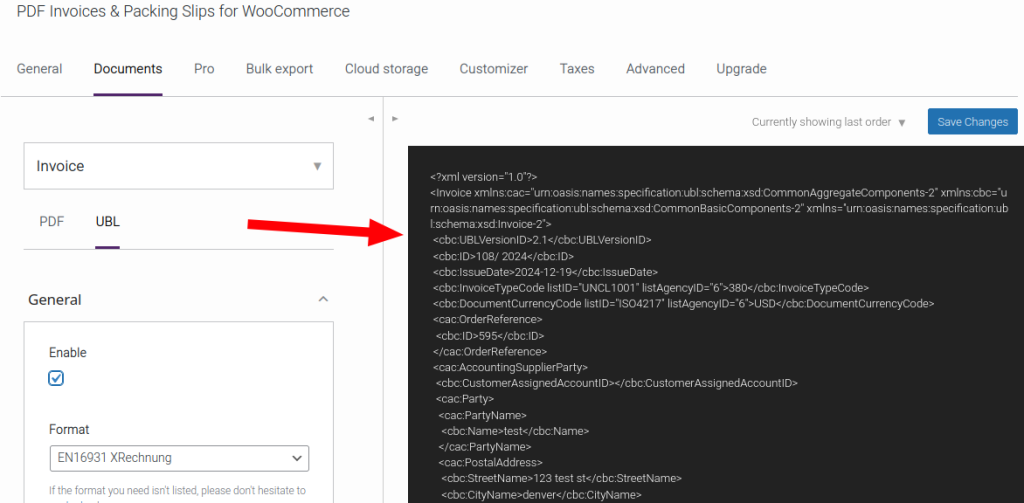

Path: WooCommerce > PDF Invoices > Documents > UBL > General.

- Make sure to enable UBL (click Enable).

- Make sure the selected format is EN16931 XRechnung.

- Save your changes.

Once the correct format is selected, the E-invoice’s preview can be observed in the PDF Preview.

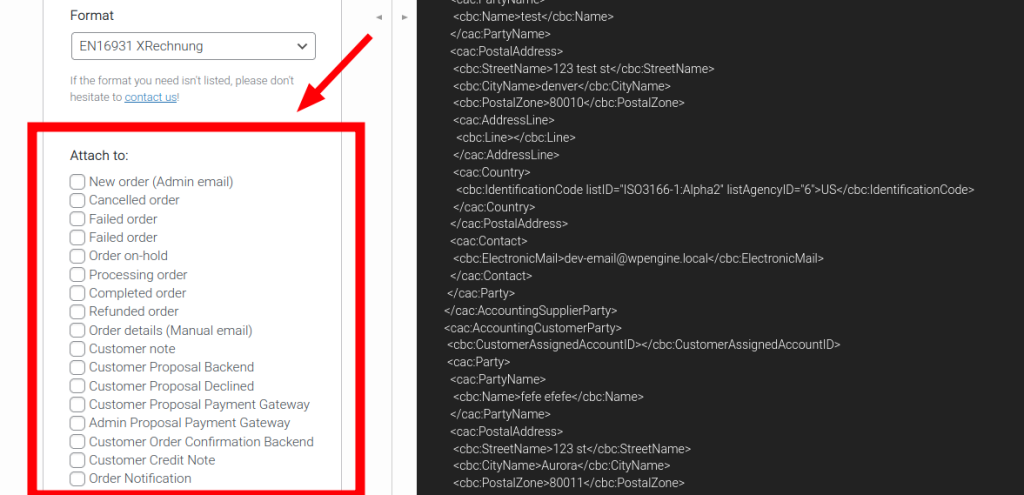

Right below the format setting, it is possible to select to which WooCommerce notification emails the XML document should be attached to (see Attach To).

Requirements for Valid XML #

For the generated XML file to be valid and compliant, certain data points need to be set.

Taxes Classification #

Path: WooCommerce > PDF Invoices > Taxes.

This needs to be filled-in, as the information is essential for accurately generating legally compliant e-invoices.

You will notice that the taxes that appear in this dropdown are from WooCommerce > Settings > Taxes (see Configuring Taxes in WooCommerce).

Note: Each rate line allows you to configure the tax scheme, category, and reason. If these values are set to “Default” they will automatically inherit the settings selected in the “Tax class default” dropdowns at the bottom of the table.

We now support VAT reverse charge if no tax item is applied to the order but the customer VAT number is valid. An example case would be using a VAT third party plugin. Skip to this list to see the plugins with which we claim compatibility.

WooCommerce Store Data #

- Email from address

- Store Address

- Store City

- Store Postcode

- Default Country Note: To avoid validation issues, ensure that rounding is disabled under WooCommerce > Settings > Tax.

PDF Invoices & Packing Slips for WooCommerce – General Data #

- Shop Name

- Shop Address

- Shop VAT Number

- Shop Phone Number

Customer Data #

- Company Name

- Company VAT Number

- Other default customer data

Supported Customer VAT Number Plugins #

- WooCommerce EU VAT Number

- WooCommerce EU VAT Compliance

- Aelia EU VAT Assistant

- EU VAT Number for WooCommerce (WP Whale / former Algoritmika)

- YITH WooCommerce EU VAT

- German Market

- Germanized Pro

If you need support for another plugin, feel free to contact us.

Modifying Taxes #

Our plugin stores the tax item meta-data when the WooCommerce order is placed, if you change the taxes table afterwards, the “Test mode” setting must be enabled to see the latest changes on the documents. This meta-data is also refreshed if you regenerate the document.

See Generating Documents with the Latest Settings

Validation #

You can validate the generated XML file using: